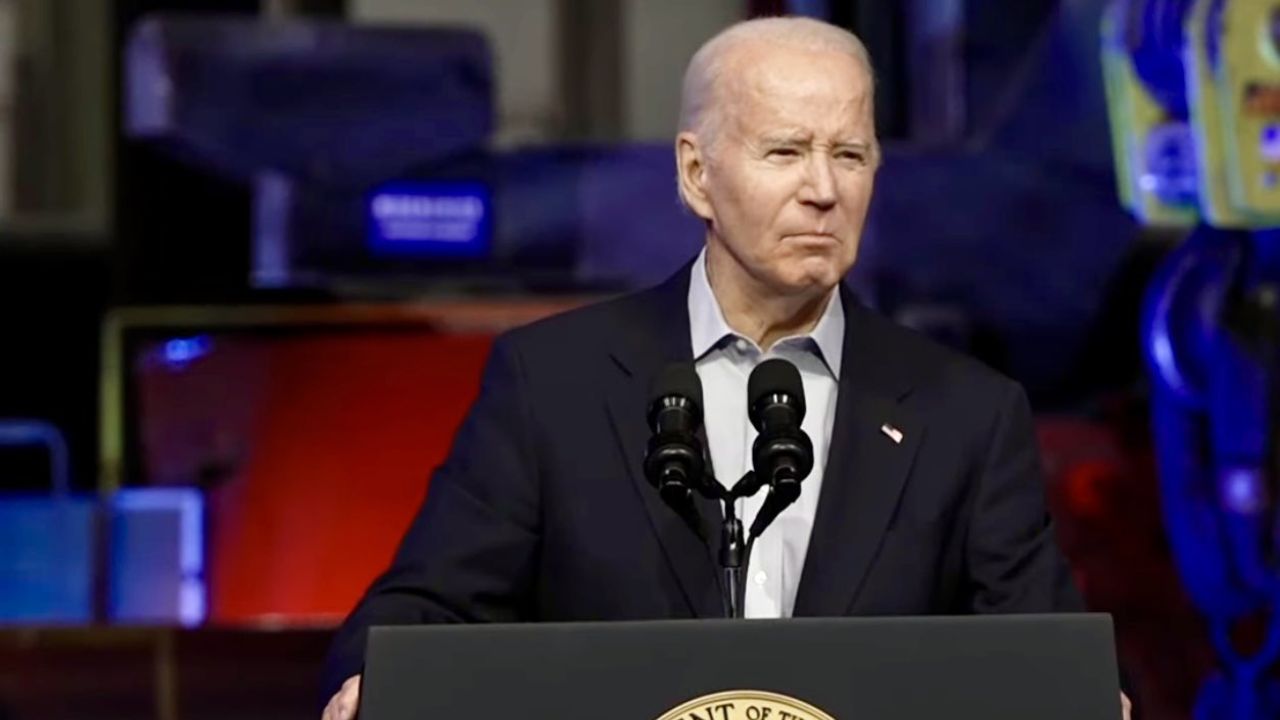

WASHINGTON (Diya TV) — President Biden outlined his vision for a potential second term on Monday, revealing a $7.3 trillion budget proposal geared towards bolstering the economy and funding new initiatives. With a focus on addressing concerns over high housing and childcare costs, Biden aims to increase taxes on corporations and high earners to alleviate the deficit and finance essential programs.

In his proposed budget for the 2025 fiscal year, Biden intends to raise the corporate income tax rate from 21% to 28% and ensure that individuals with wealth exceeding $100 million pay a minimum of 25% of their income in taxes. Additionally, the plan includes provisions to allow government negotiation for lower drug costs. These measures are coupled with plans to reintroduce a child tax credit for low- and middle-income earners, invest in childcare programs, allocate funds for housing construction, provide paid family leave for workers, and allocate resources for law enforcement.

During an event in New Hampshire, Biden criticized his predecessor, Donald Trump, and his proposed tax breaks for the wealthy and corporations. He emphasized his commitment to fairness and pledged to continue advocating for equitable tax policies.

However, Republican House Speaker Mike Johnson swiftly rejected Biden’s proposal, labeling it as reckless spending and a disregard for fiscal responsibility.

The release of Biden’s budget follows his recent State of the Union address, where he highlighted the divergence in values between his administration and the previous one. The proposed budget sets the stage for a potential reelection campaign against Trump later in the year.

Despite Biden’s efforts to address economic concerns, recent polling indicates that many Americans still favor Trump’s handling of the economy. Biden’s campaign faces the challenge of overcoming these perceptions as it seeks to gain traction among voters.

Biden’s budget proposal seeks to generate an additional $4.951 trillion in tax receipts over the next decade, primarily through tax hikes on businesses and wealthy individuals. This revenue, along with measures to reduce deficit spending by $3 trillion over ten years, aims to stabilize the national debt, which currently stands at $34.5 trillion.

While Biden’s budget has garnered some support, including from deficit-reduction advocacy groups, it faces opposition from Republicans who advocate for a more restrained approach to government spending and taxation. Biden’s budget outlines a comprehensive plan to address key economic and social issues, setting the stage for a potentially contentious debate in Congress over fiscal policy and priorities.