NEW YORK (Diya TV) – In a recent report released by the International Monetary Fund (IMF), Asia is expected to contribute roughly 60% of global economic growth this year. The IMF upgraded its view on the region, citing strong momentum.

The projection for the region indicates a growth rate of 4.5% this year, an increase of 0.3 percentage points from the October forecast. The growth is expected to slow slightly to 4.3% in 2025, according to a regional economic outlook presented by the IMF’s Asia and Pacific Department.

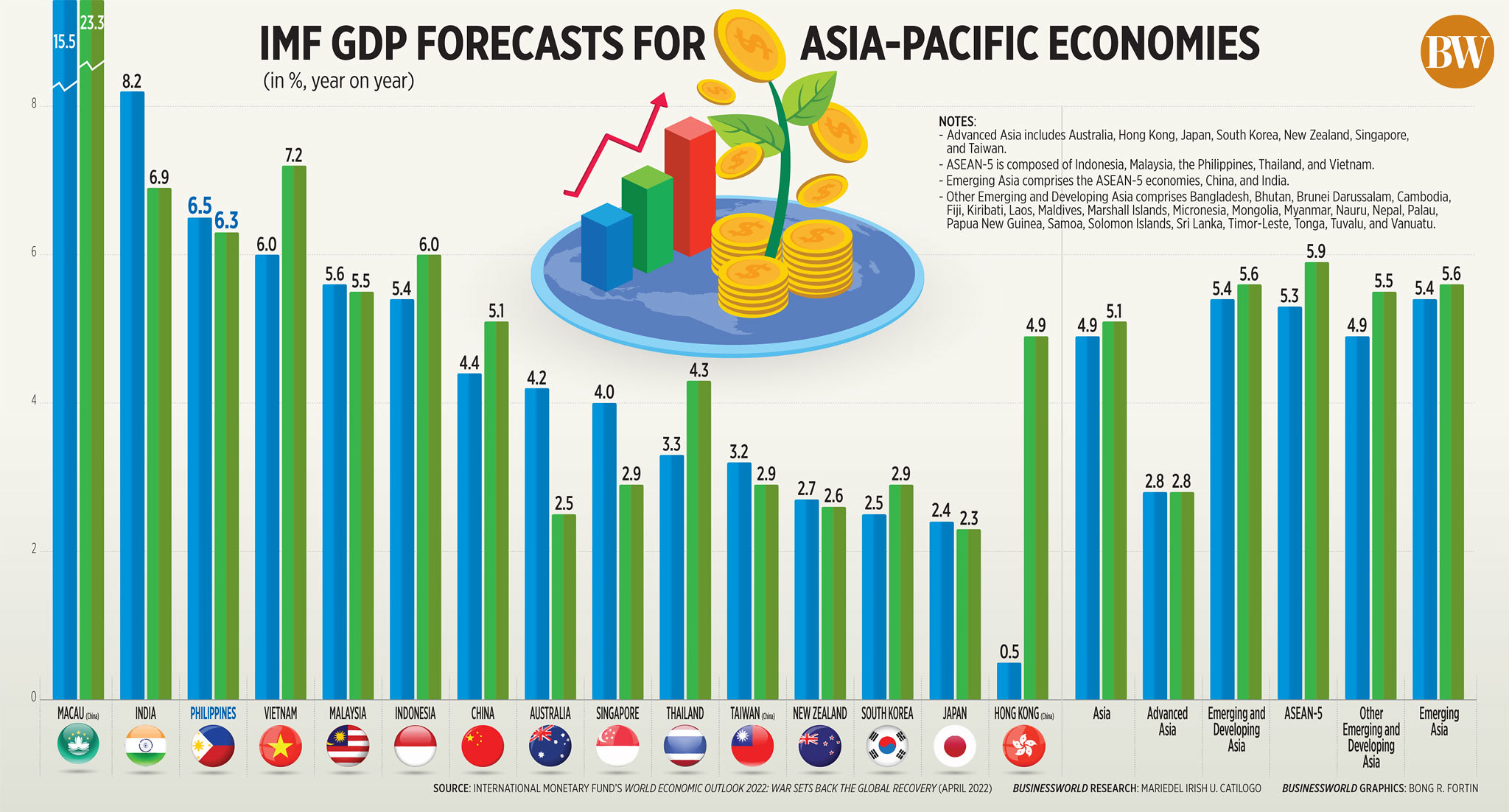

India and China are anticipated to be the biggest drivers of this growth. India is forecasted to grow by 6.8% this year, the fastest pace of any major economy, while China is expected to expand by 4.6%.

The ASEAN-5 — Indonesia, Malaysia, the Philippines, Singapore, and Thailand — are forecasted to rise by 4.5%, and Vietnam is projected to achieve gross domestic product growth closer to 6%.

The shape and drivers of Asia’s growth, however, will vary significantly among countries. Investment is expected to fuel much activity in China and India, while private consumption will be the main engine for other emerging markets in Asia, the IMF said. For some advanced economies like South Korea, exports — driven by global demand for semiconductors — will lead the way.

U.S. monetary policy will remain an external challenge for economic activity in the region. Several Asian currencies, notably the yen, have weakened due to the interest rate gap with the U.S. as the Federal Reserve holds rates steady at a 23-year high. The IMF suggests that central banks focus on domestic inflationary pressures in making policy decisions rather than responding to what the Fed does.

“Countries should not orient their policies rigidly to what they expect the Fed to do, or what they expect the dollar to do,” said Krishna Srinivasan, IMF director for the Asia and Pacific Department.

Top finance officials from the U.S., Japan, and South Korea expressed concerns over the recent weakness in the yen and the won on Wednesday and vowed to maintain close communication over volatility in the currency market.